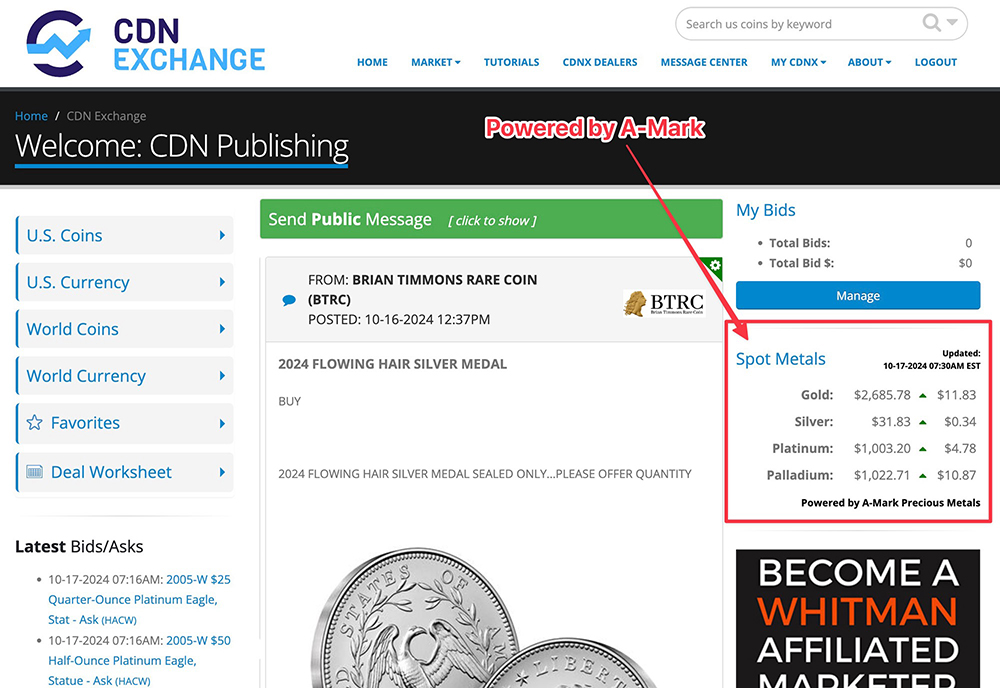

CDN Exchange Partners With A-mark To Provide Dynamic Bullion Spot-pricing To Its Exclusive Dealer Trading Platform

Partnership allows CDN Exchange™ to leverage A-Mark’s comprehensive market data with the #1 dealer-only online exchange platform for coins and currency.

by Whitman Publishing |

Published on October 18, 2024

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe to The Greysheet for the industry's most respected pricing and to read more articles just like this.

CDN Exchange™ (CDNX), the #1 dealer-only online exchange of market makers of collectible rare coins and currency, nowutilizes the precious metal spot pricing data from A-Mark Precious Metals, Inc. Spot prices are updated every 15 minutes and are then utilized to re-calculate hundreds of thousands of current values of spot-based collectibles.

“Data sourced through A-Mark will further enhance our already popular CDN Exchange online platform,” said John Feigenbaum, President and CEO of Whitman Brands™. “A-Mark is one of the industry’s leading wholesalers of bullion-related products and we are super excited for the partnership and the added value this dynamic pricing will bring to our members."

CDN Exchange

CDN Exchange is the fastest-growing and industry standard dealer-to-dealer exchange in the numismatic community, reflecting over $1.25 billion in active bids by the top coin dealers in the world while providing users with dynamic, at-a-glance perspectives of trading activity and actual market bids on PCGS, NGC/PMG, and CAC certified coins and currency from all major U.S. series in a wide variety of grades. Recognizing the marketplace has many pitfalls and dangers to consumers and reinforced by our comprehensive company pledge and member code of ethics, our goal is to guide buyers to safe transactions. CDNX’s active members include the industry’s largest market makers and auction houses like CAC, Heritage Auctions, Stack’s Bowers, Witter Coin, Universal Coin & Bullion, Legend Numismatics, Rarcoa, APMEX, GreatCollections, and more.

A-Mark Precious Metals

A-Mark is a leading fully integrated precious metals platform that offers an array of gold, silver, platinum, palladium, and copper bullion, numismatic coins, and related products to wholesale and retail customers via a portfolio of channels. The company conducts its operations through three complementary segments: Wholesale Sales & Ancillary Services, Direct-to-Consumer, and Secured Lending. The company’s global customer base spans sovereign and private mints, manufacturers and fabricators, refiners, dealers, financial institutions, industrial users, investors, collectors, and e-commerce and other retail customers.

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment